The Best Dog Insurance Companies

From unexpected accidents to unforeseen illnesses, our loyal friends can face health challenges that demand swift and comprehensive care. In the world of veterinary medicine, the costs associated with ensuring the well-being of your canine companion can be daunting. That's where dog insurance steps in, providing financial support and peace of mind when you need it most.

But what type of insurance are you looking for? In this article, we’ve evaluated the top 10 pet insurance options for 2024. Whether your canine companion is a lively pup or a wise old friend, our guide aims to provide clarity on the best insurance choices that cater to the diverse needs of doggy parents.

How to Select the Best Insurance?

Choosing the best dog insurance policy involves a few important steps. First, you need to understand deductible options (i.e., the amount you pay upfront for vet bills before your coverage starts reimbursing you) and pick one that fits your budget.

Also, be mindful of the reimbursement process, waiting period (i.e., the duration before the policy becomes effective), and coverage choices to make sure your dog gets comprehensive protection.

Evaluate policy limits and reimbursement percentages. Look into customer reviews, the network of veterinarians, and how efficient the claims process is. When comparing costs, be suspicious of significantly lower prices. Don't forget to check for extra benefits (especially if your dog has specific health conditions that you expect will need treatment), and make sure the insurance company is financially stable.

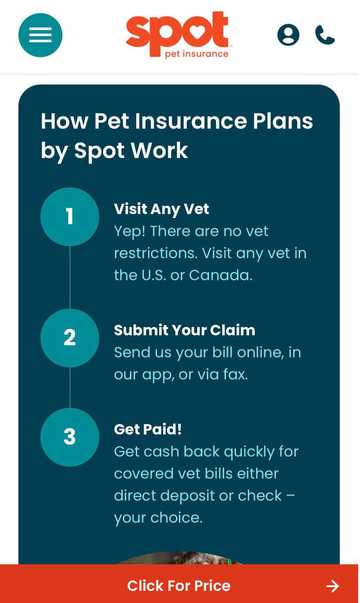

#1. Spot

Spot pet insurance offers a variety of coverage options tailored to meet the diverse needs of pet owners. With an average cost* of $59 per month for unlimited annual coverage, Spot plans provide flexibility and value. These plans feature deductible amounts ranging from $100 to $1000 and reimbursement options of 70%, 80%, or 90%.

*depends on the breed, age, and where you live

Coverage options

What sets Spot plans apart is the inclusion of an unlimited annual limit option with no per-incident or lifetime caps. Coverage extends to accidents, illnesses, hereditary and congenital conditions, behavioral issues, and alternative treatments. Additionally, the plans cover exam fees, microchip implantation, selected dietary supplements, and various wellness options.

Spot insurance does not cover pre-existing conditions, breeding-related expenses, elective or cosmetic procedures, or injuries resulting from intentional, malicious, or negligent activities.

Waiting periods and reviews

Spot does provide a quick turnaround with a 14-day waiting period for accidents (no waiting period for hip dysplasia or cruciate ligament issues) and 14 days for illnesses.

The company’s insurance has received high ratings, with a 4.2 out of 5 score from Forbes Advisor, a 5.0 out of 5 score from NerdWallet, and 4.7 out of 5 on Trustpilot.

Network of vets, add-ons, availability

Spot allows pet owners to use any licensed veterinarian in the U.S., and it comes with a 24/7 vet helpline.

The insurance includes coverage for vet exam fees and introduces an optional wellness plan, extending comprehensive care. This expanded service is now available in all 50 U.S. states and has been launched in Canada.

#2. Lemonade

Lemonade pet insurance, with an average cost of $31 per month, offers flexible plans to suit your needs and wants. You can choose from reimbursement amounts of 70%, 80%, or 90%, and deductible options of $100, $250, or $500.

Coverage options

The coverage extends to diagnostics, procedures, and medications for covered accidents and illnesses. Additionally, Lemonade helps with various vet expenses such as vaccines, heartworm and parasite tests, dental cleanings, flea and tick medication, and annual wellness exams, depending on your chosen plan.

The insurance does not cover pre-existing conditions, neglect, or alternative/experimental treatments. However, if you opt for the physical therapy add-on, treatments like acupuncture and chiropractic care are covered. Non-accident/illness elective procedures, such as grooming and nail trimming, anal gland expression, and prescription food, are not covered.

Waiting periods and reviews

The waiting periods are 2 days for accidents, 14 days for illness-related coverage, and 6 months for cruciate ligaments coverage.

Lemonade dog insurance has received a rating of 3.5 out of 5 from NerdWallet, 3.9 out of 5 on Forbes Advisor and 4.3 out of 5 on Trustpilot.

Network of vets, add-ons, availability

It offers a network of over 30,000 vets in the U.S., though not all vets accept this insurance.

Lemonade provides add-ons for extra coverage, including preventative and wellness care, extended accident and illness coverage, and specific add-ons for vet fees, physical therapy, dental illness, behavioral conditions, and end-of-life remembrance.

Lemonade insurance is available in 32 states plus Washington D.C. and offers home policies in Germany, the Netherlands, and France.

#3. Embrace

Embrace pet insurance, with an average cost of $58 per month, provides flexible coverage with reimbursement amounts of 70%, 80%, or 90%, and deductible choices ranging from $100 to $1,000.

Coverage options

Their illness-only plan covers a broad range of conditions, including alternative therapies, behavioral therapy, breed-specific, congenital, and genetic conditions, cancer testing and treatment, chronic conditions, dental illnesses, hospitalizations, emergency care, diagnostic testing, orthopedic conditions, prescription medications, preventable conditions, and specialist care.

The accident-only plan specifically covers injuries from incidents like getting struck by a vehicle, swallowing foreign objects, and torn cruciate ligaments.

Embrace excludes coverage for pre-existing conditions, breeding, pregnancy, and whelping, DNA testing or cloning, cosmetic procedures unless medically necessary, non-medically necessary stem therapy, deliberate injuries, injuries or illnesses caused by fighting, racing, cruelty, or neglect, and avian flu or nuclear war.

Waiting periods and reviews

Waiting periods include 2 days for accidents, 14 days for illness-related coverage, and 6 months for canine orthopedic conditions.

Embrace has received top ratings, with a 5 out of 5 score NerdWallet, 4.1 out of 5 on Forbes Advisor and 4.0 out of 5 on Trustpilot.

Network of vets, add-ons, availability

You can visit and submit claims from any vet or emergency practice, and the insurance is available in Washington, D.C., and all states except Maine.*

*This information might change from time to time, so make sure you check the website for updated information

Additional features include a 24/7 vet helpline, an optional wellness plan, coverage of vet exam fees, and a category for insurers covering end-of-life expenses, such as euthanasia, cremation, or burial fees.

#3. Pets Best

Pets Best pet insurance, with an average cost of $50 per month, provides a range of options for pet owners. Choose from reimbursement amounts of 70%, 80%, or 90%, and deductible choices ranging from $50 to $1000.

Coverage options

The insurance offers comprehensive accident and illness plans, including coverage for major issues like diabetes and common ailments such as skin infections.

Coverage encompasses accidents (e.g., foreign object ingestion, car accidents), illnesses (e.g., ear infections, diabetes, cancer), hereditary and congenital conditions, emergency care, hospitalizations, surgeries, diagnostics, prescription medications, chronic conditions, dental issues, prosthetic devices, wheelchairs, physical rehabilitation, exam fees, and alternative treatments like acupuncture and chiropractic care.

Pets Best does not cover alternative therapies, health conditions as a result of neglect, elective and preventative procedures, pre-existing conditions, expenses unrelated to pet medical care, and items like vitamins, special food, or supplements.

Waiting periods and reviews

Waiting periods are 3 days for accident coverage (0 days in Maine), 14 days for illness, 6 months for cruciate ligament issues (30 days in Maine), and 14 days for hip dysplasia.

The insurance has received a rating of 5 out of 5 from Forbes Advisor, 5 out of 5 from NerdWallet, and 3.9 out of 5 on Trustpilot.

Network of vets, add-ons, availability

Pets Best allows you to choose any licensed vet, specialist, or emergency clinic.

Additional features include a 24/7 vet helpline, wellness plans covering preventive care costs, and coverage of vet exam fees with the Plus or Elite plan.

The insurance is available in all 50 states and Washington, D.C., as well as Canada.

#5. Figo

Figo pet insurance, with an average cost of $44 per month, offers comprehensive coverage with reimbursement options of 70%, 80%, 90%, and 100%, along with deductible choices of $100, $250, $500, and $750.

Coverage options

Their Accident and Illness Coverage encompasses a wide range of conditions and treatments, including orthopedic conditions, rehabilitation, mobility devices, medically necessary surgeries, prescription medications, veterinary specialist treatments, non-routine dental treatment, behavior training, and medication, holistic and alternative treatments, pet ambulances, euthanasia, emergency services, hospitalization, laboratory and diagnostic testing, hereditary and congenital conditions, chronic conditions, and cancer treatments.

Figo excludes coverage for pre-existing conditions, experimental procedures, breeding, pregnancy or birth, cloned pets or cloning procedures, cosmetic surgery, and most parasites.

Waiting periods and reviews

Waiting periods include a 1-day waiting period for accident coverage, a 14-day period for illness coverage, and a 6-month waiting period for orthopedic problems (waivable with an orthopedic conditions waiver signed by your vet within the first 30 days of the policy).

The insurance has received ratings of 4.3 out of 5 from Forbes Advisor, 4.5 out of 5 from NerdWallet, and 4 out of 5 on Trustpilot.

Network of vets, add-ons, availability

Figo works at any licensed veterinarian and is available in all 50 states and the District of Columbia.

Additional features include a 24/7 vet helpline, optional add-ons like wellness exams, vaccinations, bloodwork, spaying or neutering, heartworm prevention, and an Extra Care Pack covering cremation or burial expenses, vacation cancellation due to a pet emergency, boarding fees, advertising and rewards for lost pets, etc.

#6. Trupanion

Trupanion pet insurance, with an average cost of** $60 per month**, provides straightforward coverage with reimbursement options ranging from 50% to 100% and no deductibles.

Coverage options

Their Accident and Illness Coverage encompasses a wide range of conditions and treatments, including injuries like broken teeth or fractured bones, illnesses such as vomiting or diarrhea, hereditary and congenital conditions, surgeries, lab and diagnostic testing, hospitalizations, prescription medications, veterinary supplements, herbal therapy, and lacerations.

Trupanion excludes coverage for pre-existing conditions, wellness care, accident and illness vet exam fees, sales tax, preventable conditions, routine dental care, elective or cosmetic procedures, and conditions arising from racing or mistreatment.

Waiting periods and reviews

The waiting period is 5 days for accidents and 30 days for illnesses.

The insurance has received a rating of 2.8 out of 5 from Forbes Advisor, 4 out of 5 on NerdWallet and 3.9 out of 5 on Trustpilot.

Network of vets, add-ons, availability

Trupanion offers direct vet payment if your vet uses their software, and they have partnered with over 2,300 veterinary hospitals, according to their website.

However, there’s no coverage for vet exam fees, no 24/7 vet helpline, and no routine care plan available.

They offer the Pet Owner Assistance Package for an extra cost, covering hospitalization, advertising if your pet gets lost, burial, etc. Additionally, the Recovery and Complementary Care Rider is available for an extra cost, covering behavioral modifications, acupuncture, homeopathy, etc.

Trupanion is available in all 50 states and Washington, D.C., and offers coverage in Canada, the United States, Puerto Rico, and Australia.

###7. ASPCA

ASPCA pet insurance costs an average of $43 per month, offering reimbursement choices of 70%, 80%, and 90%, with deductibles ranging from $100 to $500.

Coverage options

This coverage includes accidents and illnesses like broken bones, torn ligaments, and hypothyroidism, covering medical services, hereditary conditions, alternative therapies, chronic conditions, behavioral issues, and more.

Exclusions include pre-existing conditions, specific dental procedures, boarding costs, experimental treatments, breeding, cosmetic procedures, and certain medical procedures conducted by the pet owner.

Waiting periods and reviews

The waiting periods are 14 days for accidents and 14 days for illnesses, with no special waiting periods for specific conditions.

The insurance has received ratings of 5 out of 5 from NerdWallet, and 4 out of 5 on Trustpilot.

Network of vets, add-ons, availability

Additional features include an optional Wellness Care plan, a 24/7 pet health line, and coverage for pet microchipping, as well as the veterinarian office visit fee for illness and accidents.

You have the flexibility to reach out to any licensed veterinarian in the U.S. or Canada, including emergency clinics and specialists.

ASPCA is applicable in all 50 states, Washington, D.C., and Canada.

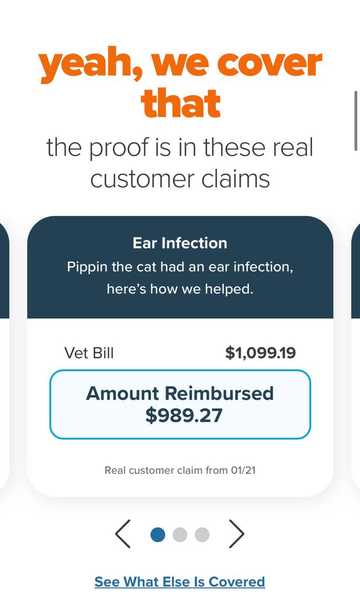

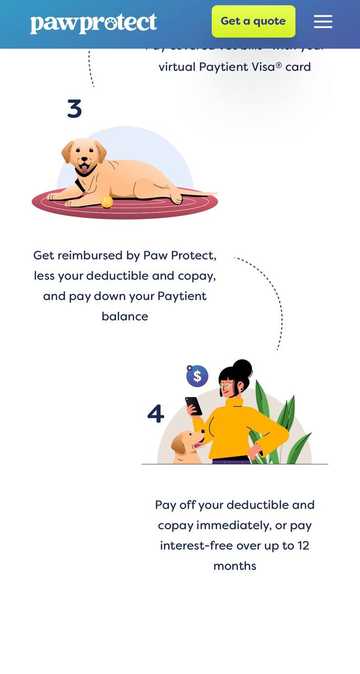

#8. Paw Protect

Paw Protect pet insurance has an average price of $50 per month and offers reimbursement options of 70%, 80%, and 90%, with deductible choices from $100 to $1,000.

Coverage options

The coverage spans a range of conditions and treatments, including alternative therapies, behavioral therapy, breed-specific and congenital conditions, cancer testing and treatment, chronic conditions, dental illnesses, diagnostic testing, emergency care, orthopedic conditions, prescription medications, preventable conditions, specialist care, and surgeries.

Exclusions involve avian flu or nuclear war, breeding, cosmetic procedures, deliberate injury, DNA testing or cloning, injury or illness from cruelty, fighting, neglect or racing, pre-existing conditions, and routine wellness care unless the Wellness Rewards plan is purchased.

Waiting periods and reviews

There's a 6-month waiting period for orthopedic conditions, reducible to 14 days with an orthopedic exam and waiver process within the first 14 days. A 2-day waiting period for accident coverage and a 14-day waiting period for illness.

Paw Protect has received ratings of 4 out of 5 from Nerd Wallet and 1.8 out of 5 from Trustpilot.

Network of vets, add-ons, and availability

Each customer receives a virtual credit card with a $2,000 line of credit to pay bills directly at vet offices or emergency pet clinics (but it has to be a certain POS vendor).

Features include coverage for veterinarian office visit fees, an optional Wellness Rewards plan, and a 24/7 pet health line. Paw Protect is available in all 50 states, Washington, D.C., and Canada.

#9. ManyPets

ManyPets pet insurance has an average cost of $36 per month, offering reimbursement options of 70% and 80%, with deductible choices of $500, $750, and $1,000.

Coverage options

The Accident and Illness Coverage includes accidents like poisoning and broken bones, illnesses such as ear infections or cancer, and various medical treatments, including blood tests, exams, hospitalization, lab work, MRIs, prescription medications, surgeries, and alternative treatments like acupuncture and chiropractic care.

Exclusions involve behavioral medication or therapy, boarding, daycare, elective or cosmetic surgeries, grooming, medications, treatments or supplements not FDA-approved, and pre-existing conditions unless the pet has been symptom-free and treatment-free for 18 months or more.

Waiting periods and reviews

Waiting periods for illness or accidents are 15 days, reduced to only 24 hours when switching from another insurer.

ManyPets has received ratings of 4.2 out of 5 from Business Insider, and 4.1 out of 5 on Trustpilot.

Network of vets, add-ons, availability

This insurance allows you to contact any licensed veterinarian.

However, it lacks a 24/7 pet telehealth line and does not cover pet behavioral therapy or alternative therapies, but it covers vet exam fees for illness and accident visits.

An optional wellness plan is available, covering dental cleaning, flea, tick, and heartworm prevention, holistic care for stress, anxiety, coat, skin, wellness exams, and more.

ManyPets is available in more than 40 states in the U.S., the United Kingdom, and Sweden.

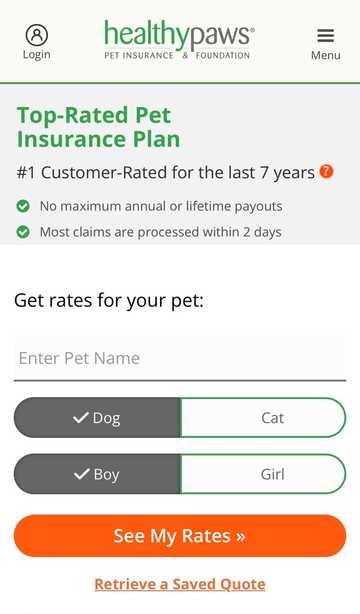

#10. Healthy Paws

Healthy Paws pet insurance, with an average cost of $56 per month, offers an average reimbursement of 80%, calculated after deductibles. Deductible options, based on age, breed, and location, include $50, $100, $250, $500, $750, and $1,000.

Coverage options

The Accident and Illness Insurance covers various conditions and treatments, including accidents, cancer testing and treatment, congenital conditions, emergency care, FDA-approved alternative therapies, hereditary conditions, hospitalizations, illnesses, prescription medications, specialty care, surgery, and diagnostic tests.

Healthy Paws does not cover behavioral training, boarding, cosmetic procedures, exam fees for injuries and illnesses, pet diets, pre-existing conditions, routine dental health care, spaying, and neutering.

Waiting periods and reviews

There's a 12-month waiting period for hip dysplasia, with no coverage if the pet enrolls at age 6 or older, and a 15-day waiting period for accidents and illnesses.

Healthy Paws has received ratings of 4 out of 5 from Forbes Advisor, 4 out of 5 from NerdWallet, and 4.6 out of 5 on TrustPilot.

Network of vets, add-ons, availability

You can visit any vet from any network, but you have to contact the insurance company first to confirm coverage and the vet's willingness to accept direct payment.

Features include a 24/7 vet helpline, although wellness or routine care coverage is not offered, and vet exam fees for accidents or illnesses are not covered.

Healthy Paws is available in all U.S. states, Washington, D.C., and Canada.

Top 10 Pet Insurance Companies: Comparison Table

| Name | Avg. monthly cost, Deductibles, Reimbursement % | Pays Vet Directly | 24/7 Helpline, Add-Ons | Ranking |

|---|---|---|---|---|

| Spot | $59/month reimbursement amounts: 70%, 80%, or 90% deductible choices: $100 to $1000 | Yes | 24/7 vet helpline available Pays for the vet exam fee Optional wellness plan available | 5 out of 5 Forbes Advisor 4.5 out of 5 score NerdWallet 4,6 out of 5 on Trustpilot |

| Lemonade | $31/month reimbursement amounts: 70%, 80%, or 90% deductible choices: $100, $250, $500 | No | Physical therapy add-on Vet visit fees add-on No 24/7 vet helpline | 4 out of 5 from both NerdWallet and Forbes Advisor 4.3 out of 5 on Trustpilot |

| Embrace | $58/month reimbursement amounts: 70%, 80%, or 90% deductible choices: $100 to $1000 | Yes, in some cases | 24/7 vet helpline Optional wellness plan Pays for vet exam feeInsurers that cover end-of-life expenses, such as euthanasia, cremation or burial fees, scored in this category | 5 out 5 on both Forbes Advisor and NerdWallet 4.2 out of 5 on Trustpilot |

| Pets Best | $50/month reimbursement amounts: 70%, 80%, or 90% deductible choices: $100, $200, $250, $500, $1000 | Yes | 24/7 vet helpline Optional wellness plans Pays for vet exam fees with Plus or Elite plan | 4 out of 5 from Forbes Advisor 5 out of 5 from NerdWallet 4 out of 5 on Trustpilot |

| Figo | $44/month reimbursement amounts: 70%, 80%, 90%, or %100 deductible choices: $100, $250, $500, $750 | No | 24/7 vet helpline Has optional wellness plans and vet fee coverage | 4 out of 5 from Forbes Advisor 5 out of 5 from NerdWallet 4.1 out of 5 on Trustpilot |

| Trupanion | $60/month reimbursement amounts 50% to 100% deductible choices: none | Yes, if your vet has Trupanion’s software | Does not cover vet exam fees No 24/7 vet helpline No routine care plan available | 4 out of 5 from Forbes Advisor 4,5 out of 5 from NerdWallet 4.3 out of 5 on Trustpilot |

| ASPCA | $43/month reimbursement amounts: 70%, 80%, 90% deductible choices: $100, $250, $500 | Yes, if the vet office allows | Optional Wellness Care plan available 24/7 vet helpline Covers vet visit fees for illness and accidents | 3 out of 5 from Forbes Advisor 4 out of 5 from NerdWallet 4 out of 5 on Trustpilot |

| Paw Protect | $50/month reimbursement amounts: 70%, 80%, 90% deductible choices: $100 to $1000 | Yes, with a virtual credit card | Optional Wellness Care plan available 24/7 vet helpline Covers vet visit fees for illness and accidents | |

| ManyPets | $36/month reimbursement amounts: 70%, 80% deductible choices: $500, $750, $1000 | Yes | Optional Wellness Care plan available No 24/7 vet helpline Covers vet visit fees for illness and accidents | 5 out of 5 from Forbes Advisor 4 out of 5 from Business Insider 3.8 out of 5 on Trustpilot. |

| Healthy Paws | $56/month reimbursement amounts: varies deductible choices: $50, $100, $250, $500, $750, $1,000 | Yes, but you have to contact the insurer before | No optional Wellness Care plan available 24/7 vet helpline Does not cover vet visit fees | 3.5 out of 5 from Forbes Advisor 4 out of 5 from NerdWallet 4.8 out of 5 on TrustPilot |

In Conclusion

In summary, choose a plan that strikes a balance between affordability and coverage. Consider the waiting period, policy limits, reimbursement percentage, and additional benefits. Review customer feedback, assess the network of veterinarians, and evaluate the claims process for a well-rounded decision.

Passionate team dedicated to help pet owners raise safe and obedient dogs, fostering meaningful connections with their furry companions.

Mattison is a Certified Professional Dog Trainer (CPDT-KA), an AKC Canine Good Citizen (CGC) evaluator.